Tidy-Liveness-Aspen

T

Tidy-Liveness-Aspen

19Following

40Followers

Short-term mainly, medium and long-term supplementary, do not look at any technical indicators, feel the market sentiment and logic, open an order at any time, when the order is not opened, it means that the entry point in the heart has not been reached, after entering the market, the trend will not meet the expected trend will be withdrawn immediately, do not carry the order to gamble, that is not the money I should make, every time I carry the order is a fluke, the market is unpredictable, once the mistake is a sharp drawdown (light 30%-40%, heavy liquidation), strict risk control, survival is more important, money is endless, but you can lose money, the most important thing in speculation is not to win money, Instead, it can stay at the table forever. There will be more short positions in a bad market or unclear, because if you enter the market in an unclear direction, it is easy to carry a big loss once the direction is wrong.

I have stepped on the top of the mountain, and I have also entered the trough, both of which have benefited me a lot, although the climbing process is long, but the scenery at the peak is worth it, failure is always the best mentor, control your fate, otherwise fate will control you.

Show original

Overview

Futures trades

Bot trades

Performance

Ongoing orders

History

Copy traders

Trading performance

Days w/ profit21Days w/ loss6

Win rate

77.78%Profit/Loss ratio

1.37:1Average position value

11,663.19Lead trader overview

Days leading trades

27Lead trade assets (USDT)

11,091.57AUM

4,086.63Current copy trader PnL (USDT)

-325.92Copy traders10/50

Profit-sharing ratio

5%Copy traders

Cumulative total40

Change in last 7 days

10(+33.33%)

*

****165+41.39

*

****871+29.27

S

Scared-Asset-Bumper+20.17

4

G

Gavin2732+9.53

5

+6.32

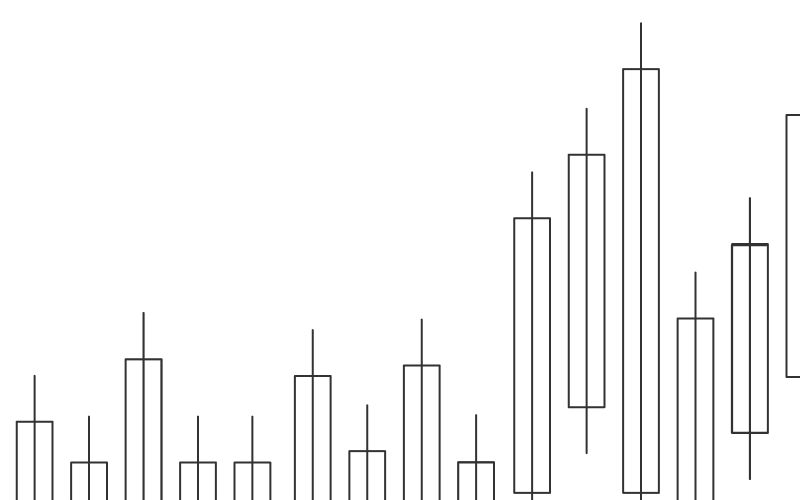

Weekly PnL

PnL%

PnL

PnL%

PnL%

PnL

Crypto preferences